-40%

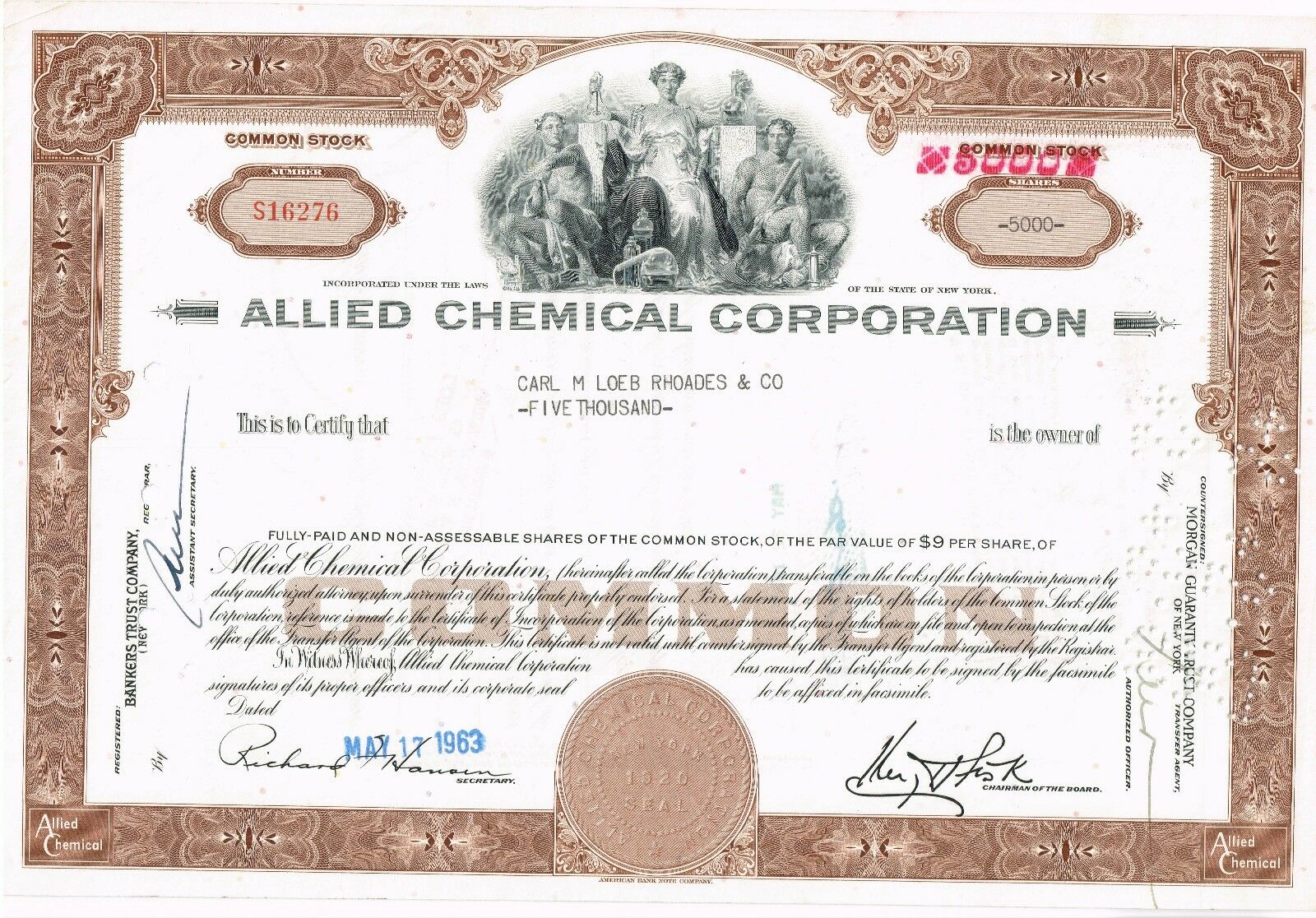

ALLIED CHEMICAL 5000 SHARES EXTRA RARE! 1963 EXTRA CLEAN

$ 13.2

- Description

- Size Guide

Description

ALLIED CHEMICAL CO 1963rare large certificate

5000 shares

NICE CONDITION

See my OTHER STOCKS AND BONDS!

all stocks are scanned

selling my complete collection!

GUARANTEED ORIGINAL - NO REPRODUCTIONS!

I COMBINE SHIPPING - SEE MY OTHER ITEMS!

Allied Chemical Corporation

List of Deals

1966

0,000,000 5.20% debentures due November 1, 1991

1968

0,000,000 6.60% debentures due August 1, 1993

1971

0,000,000 7 7/8% debentures due September 1, 1996

In 1920 several executives in the American chemical industry, including William Nichols, president of the General Chemical Company, and Washington Post publisher and financier Eugene Meyer, formed the Allied Chemical & Dye Corporation. The purpose for this merger was to consolidate the businesses of five American chemical companies established in the 1800s with complementary product lines. These companies were Solvay Process Company, General Chemical, the Barrett Company, Selmet-Solvay, and the National Aniline & Chemical Company.

Allied opened a synthetic ammonia plant near Hopewell, Virginia, in 1928, becoming the world's leading producer of ammonia. By the end of the 1920s, Allied was doing a thriving business and selling basic chemicals to the rest of American industry.

What most significantly distinguished the management of Allied Chemical from the 1920s through the 1950s was its conservatism. The company had no funded debt, never borrowed from banks, and never missed paying an annual dividend. For many of these years the company made money because basic chemicals were essential, particularly during the war years. Nonetheless, Allied during the 1960s drifted from first to sixth place in the American chemical industry because of increasingly obsolete manufacturing plants and the lack of a long-term strategy.

John T. Connor became president of Allied Chemical in 1967 and was succeeded by Edward Hennessy in 1979. Both men were responsible for making significant changes in the company. During Connor's tenure, Allied began appropriating larger expenditures for the company's more profitable businesses, like oil and gas, away from basic chemicals, and towards intermediate and end products that utilize chemicals. By 1979 oil and gas properties, operated by their Union Texas natural gas subsidiary, accounted for 80 percent of Allied's income.

In 1981 Allied Chemical changed its name to Allied Corporation and in 1983 it purchased Bendix Corporation, an aerospace and automotive firm. By 1984 Bendix operations represented 50 percent of Allied's income, while oil and gas generated 38 percent. In 1985 Allied continued to diversify by merging with Signal Companies, a manufacturer of engineered materials for the aerospace and automotive industries. The company now became Allied-Signal Corporation. This merger had the affect of making aerospace Allied-Signal's largest business sector.

The company embarked on a multi-year effort beginning in 1985 to divest non-strategic businesses and better integrate the many companies it had acquired. It sold off thirty-five businesses in 1986 through the formation and spin-off of the Henley Group. In 1992 Allied-Signal sold off its remaining interest in Union Texas and in 1993 the company changed its name from Allied-Signal to AlliedSignal to reinforce a one-company image.

AlliedSignal acquired Honeywell in 1999 in a deal valued at billion and changed its name to Honeywell International.

Spring Liquidation sale

all items